When the shareholders or executives of a company decide it is time for the company to exit, they have two options: sell their company or go public.

Both options have their advantages and disadvantages. While there is no one solution that works best for every company and situation, this post will help you decide which is best for you.

Selling Your Company

The Process

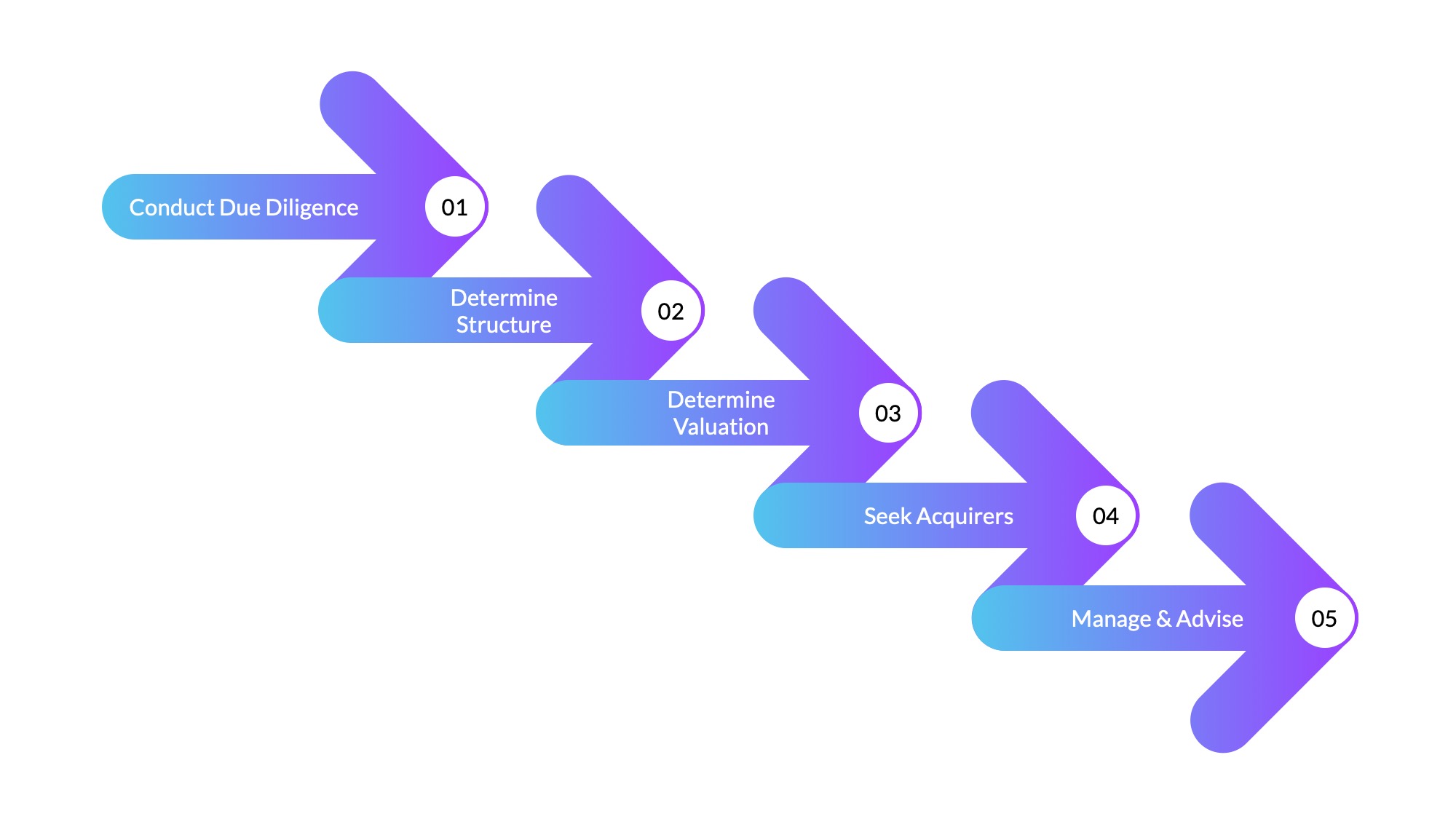

When we are retained as M&A advisors, the first step is to conduct a due diligence review. The due diligence review will assist us in remediating any issues that may scare away potential acquirers, and gives us an opportunity to become fully educated about the company to be sold.

Second, we work with the company to determine the ideal acquirer and sale structure. Sale structures can vary with regard to the amount of payment in cash vs. stock, the amount of the payment given at the time of closing or at pre-determined points in the future, and many other factors.

Third, we will determine a valuation that you will use as your company’s target acquisition price. A company’s valuation is based on a number of factors, including comparable companies that have sold or received financing recently, and is often based on a multiple of revenue or EBITDA.

We will then begin the process of reaching out to potential acquirers and garnering interest. Once a potential acquirer is interested in speaking to the company, we will set up a call or meeting with both the company and the potential acquirer.

Finally, we manage the process and make sure that the company is not being taken advantage of, and is receiving the best possible deal.

Whether you are considering an acquisition or public offering, it is important to work with an advisor whose interests align with yours, not with the acquirers or the capital partners.

Advantages

- The M&A process is generally less expensive than the IPO process.

- Companies can often receive a large percentage of the payment in the form of cash up front in an acquisition, allowing for immediate liquidity.

Disadvantages

- As part of the transaction terms, key employees usually have to maintain employment at the company for a period of time after the transaction. They will assist in transitioning new executives into the company.

- Acquisitions generally have lower valuation multiples than those of public companies.

- An acquisition does not allow for shareholders to capitalize on value escalations post-closing.

Going Public

The Process

When we are retained to structure a going-public transaction, and assist with the financing of an offering, the first step is to conduct a due diligence review. This review allows us to find and remediate any items that could may become problematic later in the process, and gives us an opportunity to become fully educated about the company.

The last step of the due diligence process is preparing a financial model. Any investment bank introduced will want to stress test the company’s financials and will use this model to assist them in determining the company’s valuation.

Once the due diligence and financial model are completed, we begin introducing the company to the investment banks that would be the best fit for the company’s proposed transaction. The investment bank will work as underwriter for the public offering and will bring the capital the company requires.

Once an investment banker has been chosen, we advise the company with respect to bridge financing prior to beginning the public offering with the investment bank, if needed. Bridge financing is generally in the form of a convertible note, and helps a company maintain steady growth while preparing for the public offering.

Similarly to the acquisition process, we work as the company’s advisor throughout the entire process and structure the offering in the most company-friendly way.

Advantages

- Public companies tend to have higher valuations than acquisitions.

- With a public offering, shareholders have the ability to capitalize on increases in your company’s valuation.

Disadvantages

- The public offering process tends to be more expensive than the acquisition process

- While shareholders can at times sell some of their shares in the public offering, they may be subject to restrictions on resale for a period of time post-closing.

Seeking an exit?

Let’s discuss which exit is the best fit for your business.