What is Due Diligence?

Perhaps the most important aspect of any corporate transaction, whether a private offering of securities, a public offering, a merger or acquisition or otherwise, is what is known as “due diligence”.

“Diligence is the mother of good fortune.” – Benjamin Disraeli

The Basics of Due Diligence

Due diligence requires the review of all material documents and other information with respect to a company in order to ensure that any disclosures which a company makes, whether in offering materials or an agreement, are true and correct and satisfies any applicable standard of liability.

What does “material” mean?

The Supreme Court has held that something is “material” if there is a substantial likelihood that it would be deemed important by a reasonable investor in making a decision to purchase or sell a company or its stock or as to how to vote their shares.

A due diligence review will inform you as to the material attributes of a company or person, including their commitments, contracts, and liabilities, their business, prospects, financial condition, and results of operations.

- Does the company exist?

- Who are the owners?

- How does the business work?

- Who are its customers?

- How do you know that a company has the contracts it claims?

- How do you know if the projected financial results are based upon accurate and reasonable assumptions?

- What are the liabilities or contingencies?

- The answer to these questions, as well as many more, lies with effective due diligence.

Due Diligence for Public and Private Securities Offerings

Securities offerings are governed federally by the Securities Act of 1933, as amended. Pursuant to Section 11 of such Act, as a general matter, if any disclosure with respect to an offering of securities contains an untrue statement of a material fact or omits to state a material fact required to be stated therein or necessary to make the statements therein not misleading, the issuer of such securities, the officers and directors of the issuer, partners in the issuer, the investment bankers conducting such offering, and professionals retained by the issuer with respect to such offering, are subject to liable for such material misstatements or omissions.

While there are no defenses to the foregoing available to the issuer and only limited defenses available to the members of the board or executive officers of the issuer, the other parties listed above may rely upon what is known as the “due diligence defense”.

The Act provides that it shall be a defense to such liability if such other party had, after reasonable investigation, e.g., a “due diligence review”, reasonable grounds to believe and did believe that the statements in such disclosure were true and that there were no omissions to state a material fact required to be stated therein or necessary to make the statements therein not misleading.

Due Diligence for Mergers and Acquisitions

In the context of mergers and acquisitions, due diligence serves the role of fact finding, disclosure checking, and confirmation, e.g., that the representations and warranties set forth in the operative transaction documents are true and correct.

While the standard of liability in this context can be modified by contract, a due diligence review ensures that the purchaser or purchasers are receiving what they believe to be correct.

Importance of Due Diligence

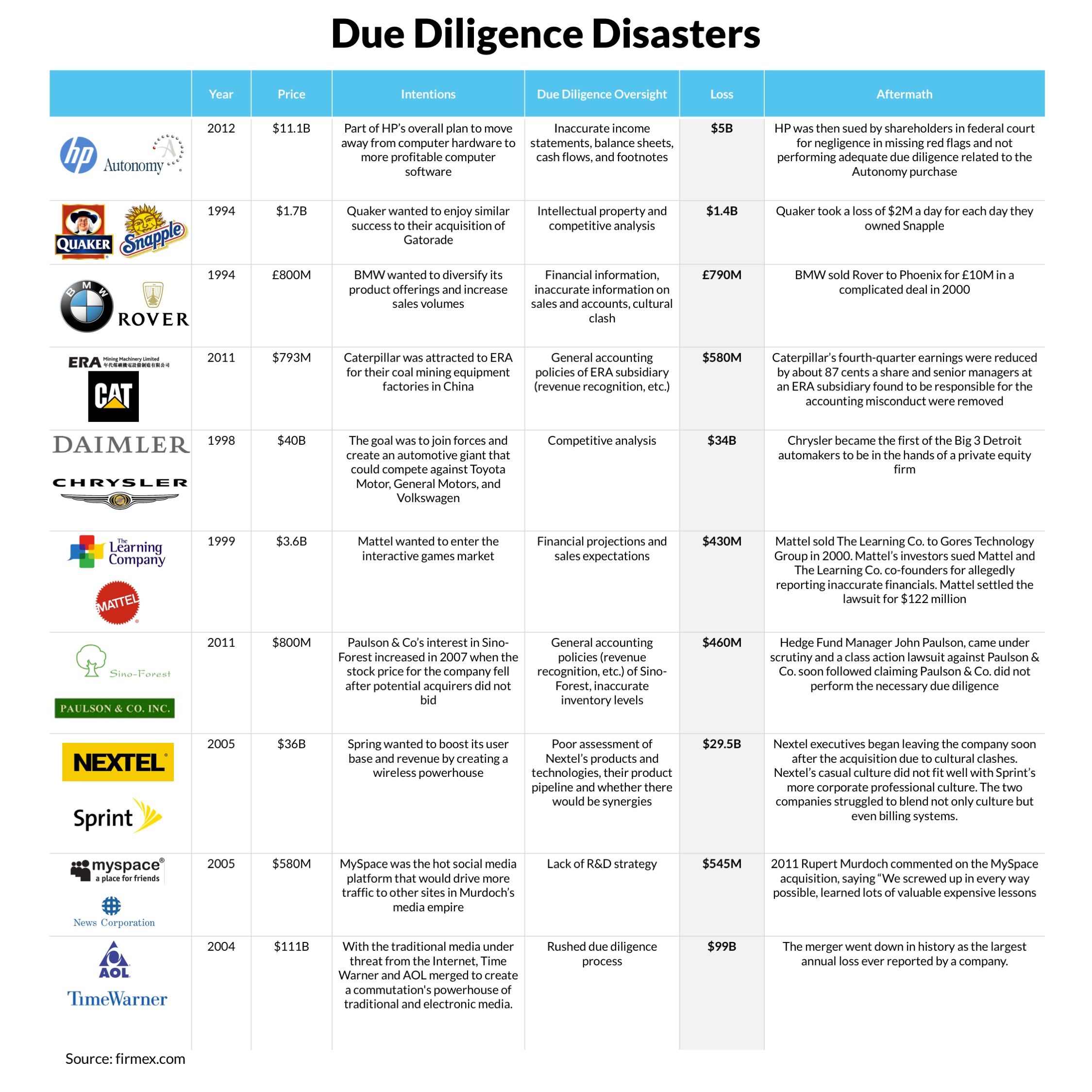

The failure to engage in a complete and effective due diligence process can be catastrophic and result in substantial litigation.

Below is a list describing some of the greatest due diligence failures of all times and some of the consequences that resulted.

ClearThink Capital’s Due Diligence Process

Any due diligence process is based upon organization: the company subject to the review will need to organize its material documents and descriptions of undocumented material facts so as to provide full disclosure in all material respects.

Although most companies can accomplish this process with little disruption, companies that have not kept complete and organized records and documents may be required to dedicate substantial time to establishing an organization process and adhering to the process.

ClearThink seeks to make the due diligence as easy and simple as possible and provides a form of initial due diligence request list that reflects the organization expected by transaction participants and provides a structure for the categorization of documents.

In order to expedite the transaction process and assure full disclosure, ClearThink does the following:

- Dataroom: ClearThink will establish for each transaction an organized dataroom in the form expected by the transaction participants and corresponding to our initial due diligence request list. ClearThink reviews and remediates the due diligence of its client in advance of disclosure to others

- Report: ClearThink will review all due diligence materials provided by its client, as well as other parties to the contemplated transaction, will document its review, and will make suggestions regarding, and endeavor to assist with, remediation, amendments, or explanation required in order to provide full, fair and accurate disclosure

- Gatekeeping: ClearThink will act as the gatekeeper to the dataroom, providing access only with the consent of the relevant parties, thereby minimizing the possibility of the compromise of sensitive data

As a philosophical matter, ClearThink is a strong proponent of full disclosure of both positive and negative information. That being said, proper management of the due diligence process will assure that corrective measures are completed prior to disclosure to third parties, thereby maximizing the probability of a successful transaction.

ClearThink and its principals have extensive experience in the management of due diligence reviews, including reviews relating to 240 public offerings raising an aggregate of $9 billion of public debt and $6 billion of public equity for companies such as The News Corporation Limited, Fox, Comcast, TCI Communications, British Sky Broadcasting, and Liberty Media, among others, as well billions of dollars of mergers and acquisitions.